Winding Down for the Season - Bookkeeping and Tax Tips for Roofers

A new year is underway, which means tax season is just around the corner. While winter keeps your roofing business on the ground, you can start preparing your 2017 taxes!

By Angie Lewis, Asphalt Life writer.

Every year, business owners sort through countless receipts and documents, trying to interpret complicated forms, in an effort to itemize expenses and determine their tax liability owed to Uncle Sam.

To help ease you through this most-dreaded task, we enlisted the advice of Joe Bazzano, Chief Operating Officer of Beacon Exit Planning. As a certified public accountant with more than 25 years of experience, Bazzano provides five suggestions that can help roofing contractors reduce their tax burden.

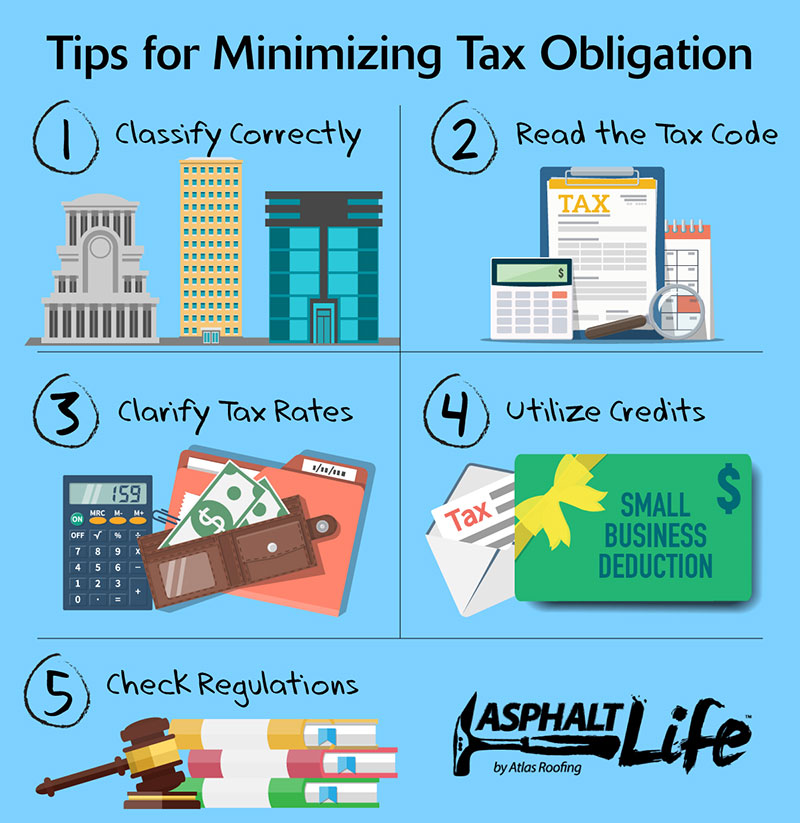

Ways to Minimize Business Tax Obligations

Entity Formation

Most business owners own their company through some form of entity — C corporations, S corporations, limited-liability companies, general or limited partnerships. Each has its own legal and tax considerations. Business structures are primarily used to protect the business owner(s) by creating a barrier between their personal and business assets. However, sole proprietorships and general partnerships do not provide the asset protection afforded other entities.

Each entity is taxed differently. In contrast to a C corporation, all other business structures are taxed at the individual level only.

Minimizing Taxes vs. Maximizing Profits

In certain situations, business owners can essentially have their cake and eat it too. The tax code provides distinct differences between deductions allowed for tax purposes and how income and expenses should be reported. A business owner can use one method to account for business operations and another to compute tax obligations. In fact, the business return even has a section that reconciles the difference between the two methods.

code provides distinct differences between deductions allowed for tax purposes and how income and expenses should be reported. A business owner can use one method to account for business operations and another to compute tax obligations. In fact, the business return even has a section that reconciles the difference between the two methods.

Methods may vary depending on the size or type of the business, and the IRS may require a business to change its accounting methods. Your financial advisor can guide you toward the right options.

Different Tax Rates

Certain types of income from the same year may be taxed at different rates. For example, income from an S corporation can be recognized as either wages or passive income. The biggest difference is that wages are subject to federal and state income taxes, as well as Social Security and Medicare taxes.

Additional Medicare and net investment income taxes may be required if income exceeds certain thresholds, depending on filing status. Passive income is only subject to federal and state income taxes. If wage income from an S corporation is below market, the IRS may consider it an unreasonable compensation issue and attempt to reclassify the income as such.

C corporation income can also be taxed differently. Wages are subject to taxes the same way that S corporation wages are taxed, however, dividends are taxed to the shareholder at 0 percent to as high as 23.8 percent based on their total income. LLCs, partnerships and sole proprietorships have their own nuances to consider.

Non-traditional Deductions and Credits

Work with your tax advisor to make sure you’re utilizing non-traditional deductions and credits that the government makes available to businesses. The Work Opportunity Tax Credit, for instance, is open to businesses that hire Americans facing significant employment barriers such as disabilities, disadvantaged households or extended periods of unemployment. Considering the labor market is getting tighter, looking into this option may make sense for your business.

Currently, some additional types of credits and deductions include the:

- Domestic Production Activity Deduction

- Research and Development Credit

- Energy-Efficient Commercial Building Deduction (aka the 179D Deduction)

Business owners in the construction trades often overlook such deductions and credits. As you head into your year-end tax planning discussions with your accountant, be sure to suggest these benefits and see if you qualify.

Expensing Regulations

Expensing regulations that provide a de minimis policy allow business owners to expense certain tangible property acquisitions and recognize loss for the replacement of building systems or structures in the year of disposition.

The de minimis policy allows a taxpayer to get a current deduction for the acquisition, thereby reducing their overall tax obligation. Prior to this policy, there was a smaller threshold for expensing that required taking a deduction over a greater number of years through depreciation. Since most contractors are capital-intensive, the de minimis policy can result in a great benefit.

In 2013, the IRS finalized regulations to make capitalization and expensing procedures easier and more uniform. The regulations simplified the capitalization policy by allowing purchases of tangible personal property to be fully expensed in the year of acquisition, as long as they were below $500. If you met certain financial statement requirements, the threshold could be increased to $5,000, as long as the capitalization policy was consistent between the tax report and financial statement reporting.

Another significant portion of the 2013 regulations concerns the capitalization of costs considered a portion of a building’s systems, which can include the roof, plumbing and HVAC. The regulations provide a flowchart for determining which costs should be classified as expenses on the income statement or capitalized on the company’s balance sheet. It also allows deductions for the portion of the building or system that is being replaced in that year. For example, if a landlord replaces a substantial portion of a building’s HVAC system, he/she may capitalize the replacement costs and also deduct the un-depreciated portion.

Be sure to discuss these topics with your tax advisor.

“With a little effort, these few tax-saving strategies can save you substantial dollars when it comes to paying your fair share,” Bazzano says. “Remember, we all have to pay taxes, but we don’t have to leave a tip!”

Editor’s note: This article first appeared on Atlas Roofing’s Asphalt Life and can be viewed here.

Comments

Leave a Reply

Have an account? Login to leave a comment!

Sign In