An intersection of opportunity and uncertainty

April 16, 2025 at 3:00 a.m.By John Kenney, Cotney Consulting Group.

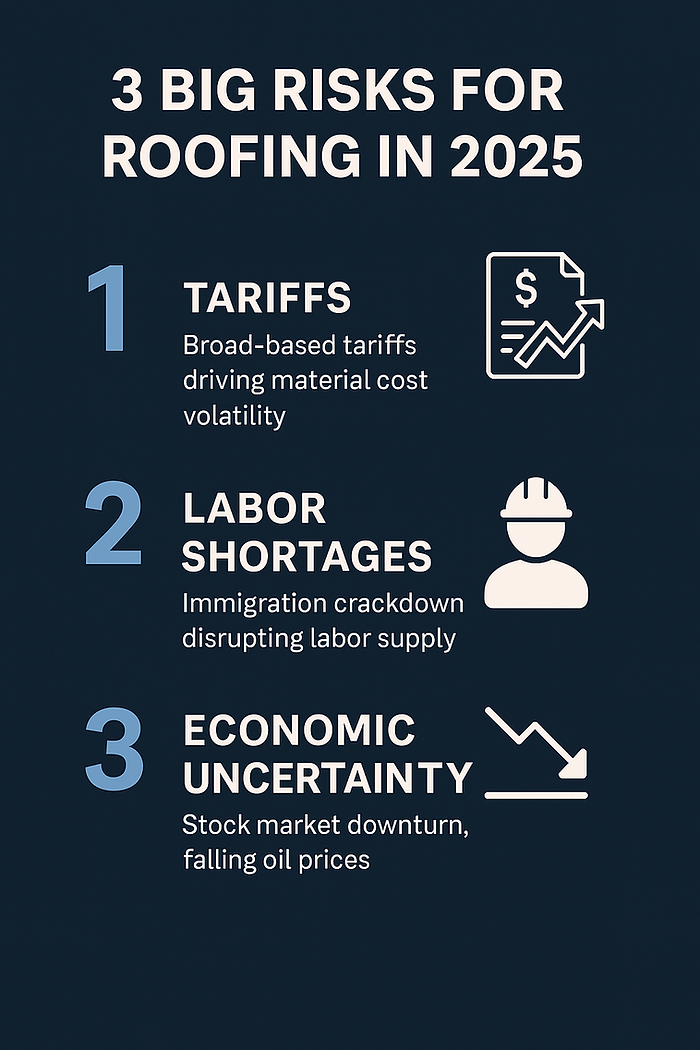

As we enter the second quarter of 2025, learn about the core factors influencing the U.S. roofing industry.

In general, there is a lot of anxiety and concern in the U.S. construction industries as we enter Q2 of 2025. With labor uncertainties, mounting broad-based tariff pressure and a tightening immigration landscape, it is natural to feel a bit stressed. But it’s important to remember that the demand across both residential and commercial sectors remains relatively strong.

In this article, we dive deeper into the core factors that are reshaping roofing contractors’ operations and the larger economic dynamics in 2025. Keep reading to learn how to navigate the evolving trade environment by recalibrating material costs, labor availability and project timelines.

Macroeconomic landscape: Elevated demand, mounting risk

The construction sector continues to be an economic bellwether and roofing — by nature of its involvement in both new builds and reroofing work — remains central to the industry's health. After several years of unpredictable disruptions, roofing professionals entered 2025 with guarded optimism. Nonresidential construction, spurred by federal incentives for infrastructure and energy-efficient retrofits, remains a source of steady work. Meanwhile, residential reroofing — often driven by aging inventory, extreme weather and insurance claims — has provided a demand baseline even as new home construction faces financing headwinds.

Yet, this resilience is being tested. The U.S. government's recent implementation of broad trade tariffs is expected to affect nearly every input of the construction supply chain. With roofing systems heavily reliant on imported materials — from metals and fasteners to polymers and chemicals used in insulation and membranes — contractors are watching their costs climb when consumers and project owners are already under budgetary stress.

Tariffs and the surge in material costs

The tariff rollout announced in early 2025 includes a sweeping 10% baseline on all imports, with targeted increases on goods from key partners, including China, Mexico and Canada. Roofing contractors, who often rely on imported components even when sourcing from domestic distributors, already feel the effects. Steel and aluminum — integral to commercial roofing decks, fasteners and flashing systems — were taxed at 25% and remain at elevated levels under the new rules. Additionally, the U.S. reinstated nearly 15% tariffs on Canadian softwood lumber, further impacting roof decking material costs.

According to a recent analysis by Dodge Construction Network, construction input prices rose at a 9% annualized rate through the first two months of 2025, with roofing-specific components outpacing the broader index. Many suppliers are issuing updated price lists on a near-monthly basis, creating a volatile estimating environment. For contractors bidding on public work, fixed-price contracts signed months ago are now putting profitability at risk.

Furthermore, anecdotal reports from suppliers indicate that inventory stockpiling has returned in some markets — particularly for imported fasteners and adhesives — echoing pandemic-era procurement behaviors. However, smaller roofing firms often lack the cash flow or warehousing capacity to adopt this strategy, putting them at a competitive disadvantage.

Labor shortages intensify as immigration crackdown escalates

Perhaps even more pressing than material costs is the ongoing — and worsening — labor shortage. The roofing industry has long depended on immigrant labor, with estimates suggesting that more than 25% of the U.S. roofing workforce comprises undocumented or mixed-status workers. With the reactivation of workplace immigration raids and stepped-up enforcement under current federal policy, job site fears have grown and the workforce pipeline is shrinking.

Reports from major metro markets, including Dallas, Atlanta and Los Angeles, indicate that roofing crews are increasingly short-handed. Many subcontractors have reported absenteeism spiking, not from lack of demand but from fear of legal repercussions. In regions with high undocumented populations, crews are being reduced by as much as 30%, according to the Associated General Contractors of America.

To compensate, contractors rely more heavily on overtime and cross-training laborers to shift between commercial and residential installations. However, this short-term adaptation is not sustainable. Without meaningful immigration reform or legal pathways for skilled construction workers, the industry faces prolonged labor disruptions, project delays and increased safety risks due to overworked and understaffed crews.

Project pipeline and backlog adjustments

As roofing firms navigate these compounded pressures, the national project backlog is beginning to reflect industry caution. While public works projects supported by infrastructure and school district funding remain active, private-sector re-roofing jobs — especially for retail and hospitality sectors — are being delayed or scaled back.

Roofing contractors are reassessing which projects to pursue and are increasingly incorporating escalation clauses in their contracts to protect against price volatility. General contractors and construction managers also lean toward firms with robust financial backing, supply chain leverage and labor continuity — putting additional strain on small to midsize roofing businesses.

Notably, while large multi-regional contractors are better equipped to absorb cost shocks and offer bonded performance, local contractors are losing market share in bid-heavy environments. The ripple effect could accelerate consolidation within the roofing industry over the next 12 to 18 months.

Strategic implications for roofing businesses

The current climate calls for more than operational adjustments — it demands a strategic recalibration. Roofing business owners should consider the following actions in response to current market signals:

- Revise estimating models frequently: To avoid underbidding, account for monthly fluctuations in material costs and develop real-time cost history databases.

- Strengthen supplier relationships: Preferred access to limited inventory can make or break project timelines. Consider joint purchasing groups or regional buying alliances.

- Address workforce stability: Explore legal employment sponsorships, workforce development programs and mentorship initiatives to retain and upskill labor.

- Build flexibility into contracts: Escalation clauses, longer material lead-time disclosures and milestone-based scheduling language should become standard.

- Assess risk exposure: Insurance providers are increasingly scrutinizing project schedules, labor availability and subcontractor reliability — factors that should be evaluated in internal risk management assessments.

Conclusion: Navigating the headwinds with strategic agility

The U.S. roofing industry in 2025 is defined by tension between demand and capacity, opportunity and volatility, growth and contraction. Roofing contractors who successfully navigate this period will be those who invest in financial discipline, workforce resilience and strategic foresight.

As trade and immigration policies shift, uncertainty is the only certainty. But within that unpredictability lies the space for innovation, collaboration and renewed leadership from contractors who recognize that roofing excellence in today's environment is no longer just about the product — it's about how you plan, protect and position your business for what comes next.

Postscript: Watching the economic weather

As of early April 2025, financial markets are flashing caution signals. The U.S. and global stock markets have entered a steady downward trajectory and oil prices have dropped to $60 per barrel — a sign that global demand may be softening. While these trends don't yet signal an immediate crisis for roofing, they reinforce the importance of staying vigilant.

Contractors should closely monitor how these macroeconomic indicators affect credit access, project financing and owner sentiment in the months ahead. Roofing backlogs could shrink if capital becomes more constrained, especially in the commercial sector. Maintaining tight estimating controls, shoring up supplier relationships and retaining skilled labor remain the best defenses against volatility in the broader economy.

Original article source: Cotney Consulting Group

Learn more about Cotney Consulting Group in their Coffee Shop Directory or visit www.cotneyconsulting.com.

Comments

Leave a Reply

Have an account? Login to leave a comment!

Sign In