Webb Analytics' 2024 Construction Supply 150 reveals biggest revenue drops at dealers since the Great Recession

Blame lumber’s price plunge, a slowdown in construction and fewer DIY sales, but dealers predict a modest recovery this year.

Three-quarters of America’s most important sellers of building materials recorded sales declines in 2023, collectively taking in $386.03 billion from their U.S. operations, Webb Analytics’ latest Construction Supply 150 (CS150) reveals.

Industry-wide revenue drops of this scale haven’t been seen in 15 years, when the Great Recession caused housing starts to plummet. This year’s 4.7% drop follows years in which the Construction Supply 150 grew 19.2% in 2022 and 9.5% in 2023. (Because of mergers and acquisitions, each CS150 group is slightly different but still comparable). The CS150 arguably accounts for nearly two-thirds of all construction product sales in America.

The biggest reason for the decline was lumber. Commodity lumber prices skyrocketed in 2021 and stayed high in 2022 before plunging 48% in 2023. As a result, revenues among lumberyards with manufacturing on the CS150 soared 58.6% in 2021 and another 18.1% in 2022. But in 2023, lumberyards with manufacturing ops shrank 22.7%.

Lumberyards without manufacturing operations are slightly less dependent on bulk lumber sales, but they still dropped 11.9%. Meanwhile, hardware and home centers reported 2.7% less revenue. And specialty dealers — companies that primarily sell products like roofing and siding, with very little lumber — saw a 5.1% sales increase.

“You might think a year in which 75% of all CS150 companies suffer revenue declines would be reason for panic, but that’s not the case,” said Craig Webb, president of Webb Analytics. “The Great Recession was a deadly cocktail of toxic mortgages and homebuilding mania that ultimately caused housing starts to plunge 75%. The drop in 2023 was more like a steep roller-coaster dip after a climb to unsustainable heights. Dealers actually are feeling good about the future. On average, CS150 members predict sales will rise 4.4% this year.”

The entire 61-page PDF report is available for download at https://www.webb-analytics.com.

Some of these numbers might differ from what CS150 companies have reported publicly because the report separates members’ activity in Canada and Mexico. Operations in those countries added $15.92 billion worth of revenue to CS150 members’ coffers.

The CS150 collects data for most but not all of the biggest building material suppliers, but it isn’t an exact list of the nation’s 150 biggest dealers because some private companies decline to reveal their numbers. Webb Analytics estimates the entire construction supply market shrank 3.3% last year to $595 billion..

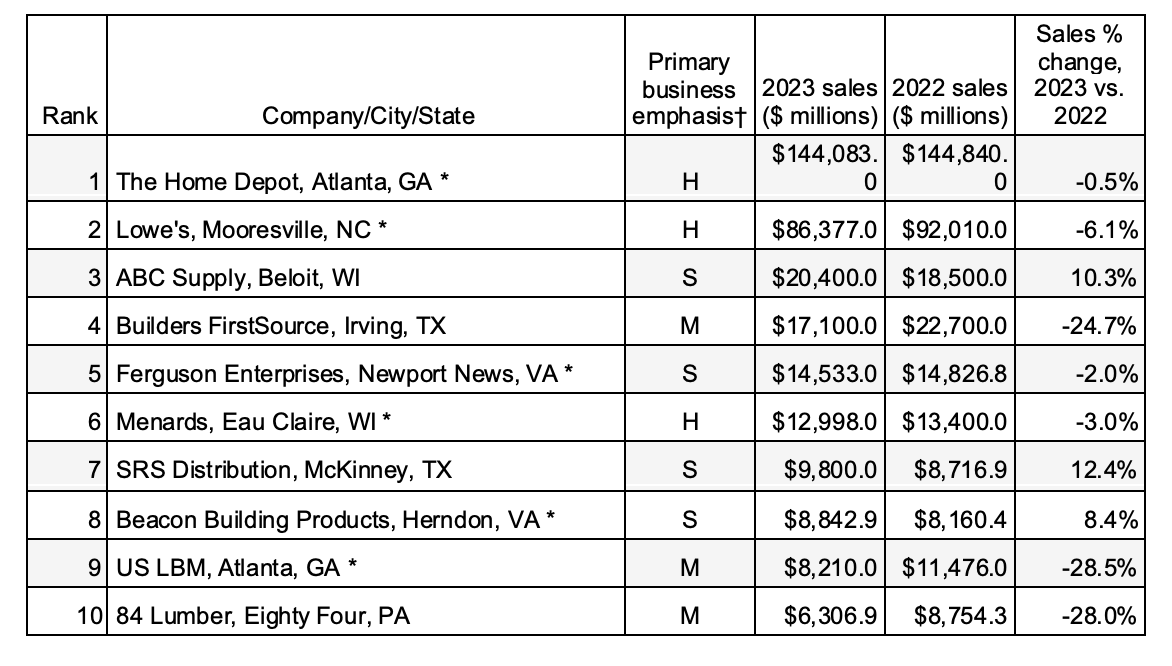

Here are the top 10 dealers on the 2024 CS150 List:

About Webb Analytics

Webb Analytics is a data and research consultancy that helps executives in construction supply spot the trends, threats, and opportunities that matter most. It’s led by Craig Webb, one of the nation’s best-known industry figures and the former editor-in-chief of ProSales, the construction supply industries most honored publication. Aside from the Construction Supply 150, Webb Analytics also produces an annual deals report, consults with dealers, publishes research reports, and speaks at industry events. Contact him at cwebb@webb-analytics.com.

Comments

Leave a Reply

Have an account? Login to leave a comment!

Sign In