Consider How Natural Disasters are Creating Material Shortages

By Meta Team.

Learn how natural disasters of the past year have contributed to the roofing industry’s current supply chain challenges.

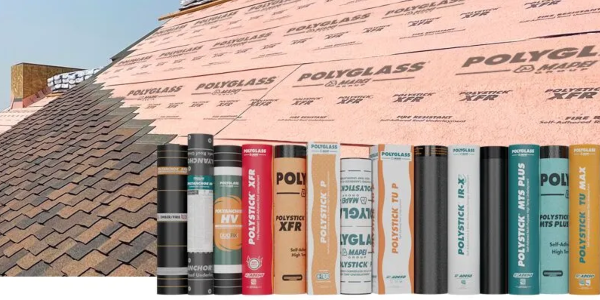

It is no secret that the roofing industry is experiencing a material shortage. We often discuss how to respond to a lack of materials or chalk the scarcity up to the pandemic, but rarely do we consider how much of the material shortage is a combination of different factors. Luckily, we have done the research for you, offering explanations to consider as we navigate these unprecedented times. In this article, we examine how natural disasters have contributed to material shortages, read on to learn about how the weather has exacerbated material shortages.

The Gulf of Mexico and the oil and gas industry

The roofing industry is dependent on the petrochemical industry to produce polyurethane which in turn becomes a myriad of other chemicals. Polyurethane is made from crude oil. Therefore, the petrochemical industry is, in turn, dependent upon the Oil and Gas industry.

Below is a link to a map of the location of the petrochemical companies in the United States that supply to the roofing and other industries:

www.petrochemwire.com/storm-coverage

These locations lie all along the Gulf of Mexico. The Gulf of Mexico region suffered three natural disasters in 2021 that have caused scarcity and skyrocketing prices.

The first of the disasters was Winter Storm Uri which hit the Texas and Louisiana area in February 2021. According to data from IHS Markit (see references):

As winter storm Uri hit the Texas-Louisiana area in February, several sites shut down or ran at reduced rates in the chemical industry. The freezing temperatures affected power and water supply across Texas, setting back recovery efforts. Winter Storm Uri has impacted nearly 78 percent of U.S. ethylene supply…

Polyurethanes (MDI, TDI, PO and polyols)

With all US MDI production centered in the US Gulf Coast, all producers have been affected. Dow stopped propylene oxide operations at both its Freeport, Texas site and at Plaquemine, Lousiana in the wake of the storm. Indorama took its PO/TBA line down along with its other operations in Port Neches, Texas, while LyondellBasell also halted production in Pasadena, Texas and on its other POSM line in Channelview, Texas.

The next natural disaster was Hurricane Ida which hit August 2021 as a category four hurricane. The storm had immediate and widespread impacts on the US crude supply chain. This, in turn, impacted petrochemical manufacturers. Ahead of the storm, Marathon, PBF, Phillips 66, Placid, Shell, Valero and Exxon shut down facilities in the Gulf of Mexico in the path of the storm. According to data from Wood Mackenzie (see references):

Generally, the GoM production impact from hurricanes lasts approximately 10 to 15 days from initial shut-ins, though this timeline is shorter if comparing to landfall date, according to our historical data. Just like refineries, that timeline can be prolonged by infrastructure damage. Offshore GoM crude production fell 1.755mn bpd to 353,000 bpd between 24 August and August 28.

Many petrochemical companies in the area were under force majeure prior to Ida’s making landfall (see references) as they were unable to get the plants online and the raw material they need from the Oil and Gas industry in the region.

The third and most recent hit was Hurricane Nicholas which made landfall fifty miles south of Houston on September 2021. This hurricane was less than three weeks after Hurricane Ida. The region was struggling to recover when this third natural disaster hit. According to the Department of Energy’s Hurricanes Ida and Nicholas update #19 (see references):

Oil and natural gas sector summary

-

As of 12:30 PM EDT, September 17, 23% of the oil production and 34% of the natural gas production in the federally administered areas of the U.S. Gulf of Mexico remained shut-in, according to estimates by the Bureau of Safety and Environmental Enforcement. In the Gulf of Mexico, cumulative production loss has totaled approximately 28 million barrels of crude oil and 34 barrels per cubic feet (b/cf)f of natural gas production.

-

Two refineries in eastern Louisiana remain shut from Ida, accounting for about 0.5 million barrels per day (b/d) of refinery capacity, or approximately 3% of the total U.S. operable refining capacity. Five refineries have returned to operational status, while two other refineries are in the process of restarting but remain below normal operating rates. Fuel and crude oil stocks in the area are being drawn down from storage while refineries and offshore production are restored.

The impact of these three natural disasters is two-fold. First, scarcity is causing long (8 months+) lead times. The second impact is to product pricing. As manufacturers cannot predict or control their upstream costs, they cannot tell roofing contractors what material costs will be. They have all been unable to honor the quotes of any materials and have shifted the model such that the price of the materials is the price at time of delivery. This pricing model is unheard of in the roofing industry and has left all roofing contractors unable to offer solid delivery dates or pricing on jobs.

For more insight into reasons why we are experiencing material shortages, check out Meta Team's website!

Original article source: Meta Team

-2025-xtv-mls-tour-2.png)

Comments

Leave a Reply

Have an account? Login to leave a comment!

Sign In